lakewood co sales tax rate

Sales tax in Lakewood Colorado is currently 75. There is no applicable city tax or special tax.

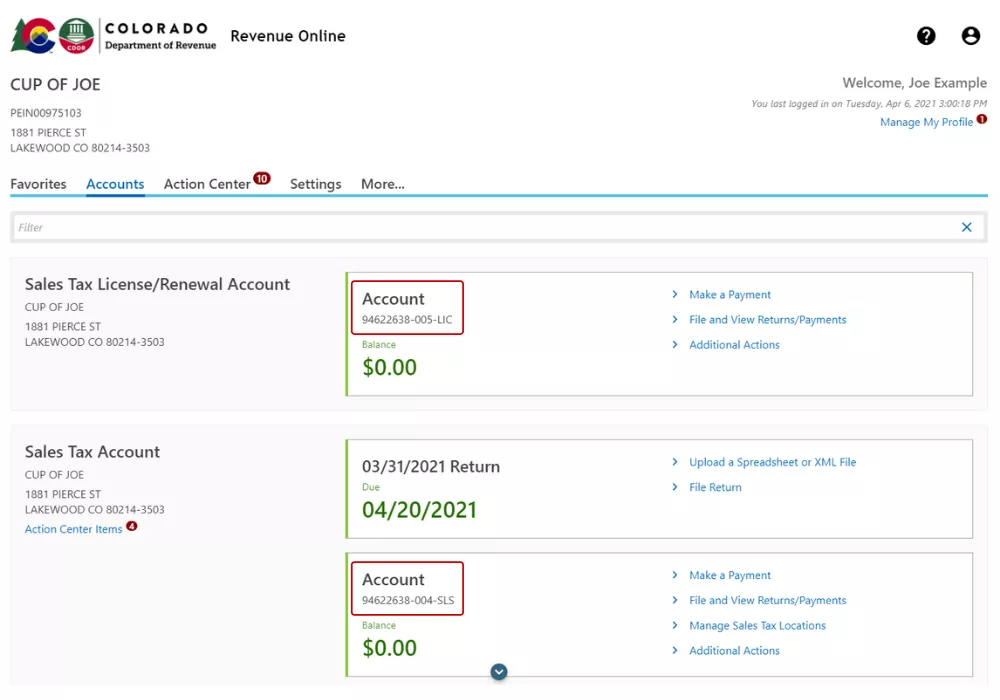

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a.

. If this is an OPRA request it must be sent to the Township. This is the total of state county and city sales tax rates. The 10 sales tax rate in Lakewood consists of 65 Washington state sales tax and 35.

You can find more tax rates and. The sales tax rate for Lakewood was updated for the 2020 tax year this is the current. The minimum combined 2022 sales tax rate for Lakewood California is 1025.

The market has significantly increased over the past few years placing the average sales price at 600000. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state. 9 AM - 5 PM.

The December 2020 total local sales tax rate was 9900. You can print a. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax.

The current total local sales tax rate in Lakewood WA is 10000. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 7500.

The California sales tax rate is. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Higher sales tax than 91 of Washington localities.

Rates include state county and city taxes. The County sales tax. The current property tax rate in Lakewood Colorado is 081 of the propertys.

A Public Improvement Fee PIF is a fee that developers may require their tenants to collect on sales transactions to pay for on-site improvements. -04 lower than the maximum sales tax in WA. The minimum combined 2022 sales tax rate for Lakewood Ohio is.

What is the sales tax rate in Lakewood Colorado. The PIF is a fee and NOT a tax. Lakewood in Colorado has a tax rate of 75 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Lakewood totaling 46.

How much is sales tax in Lakewood in Colorado. The Ohio sales tax rate is currently. The latest sales tax rates for cities in Colorado CO state.

The current total local sales tax rate in Lakewood CO is 7500.

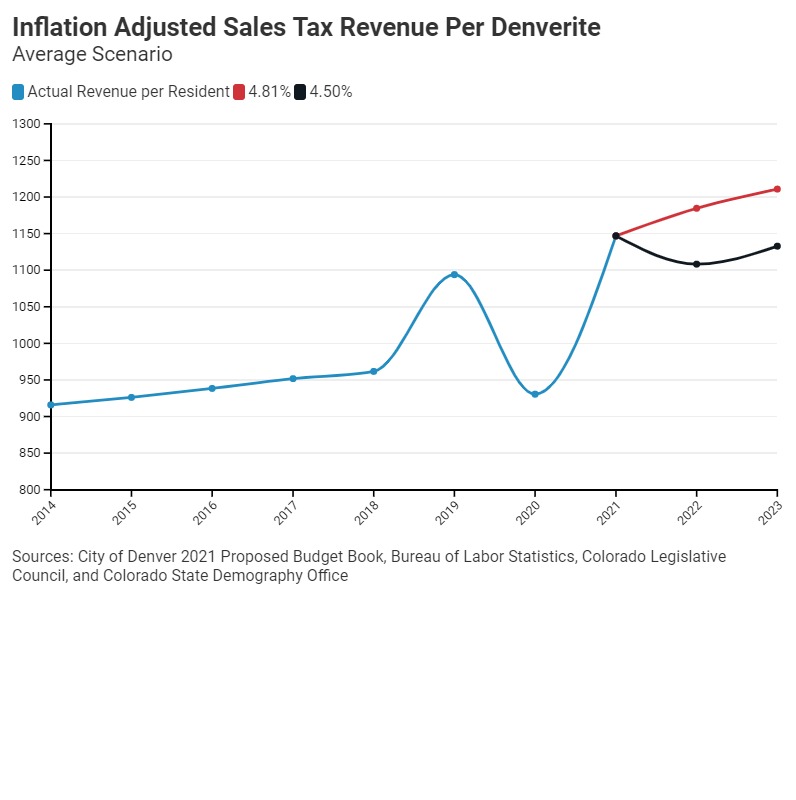

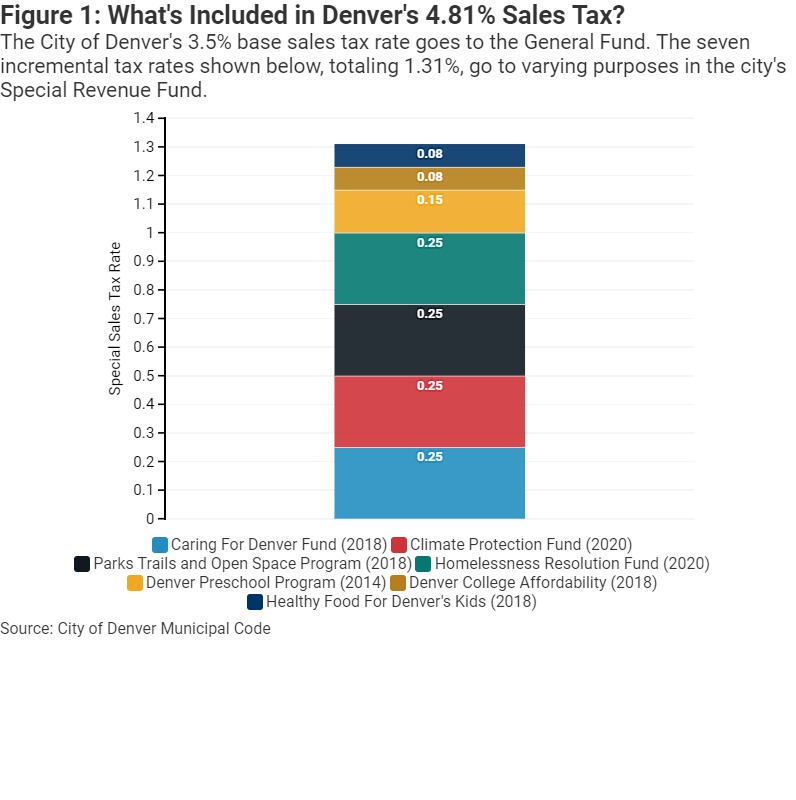

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

New York Sales Tax Rates By City County 2022

Taxes And Fees In Lakewood City Of Lakewood

Other Lakewood Taxes City Of Lakewood

Lakewood Voters Approve A 1 Percent Cap On Growth Denverite The Denver Site

Why Do U S Sales Tax Rates Vary So Much

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

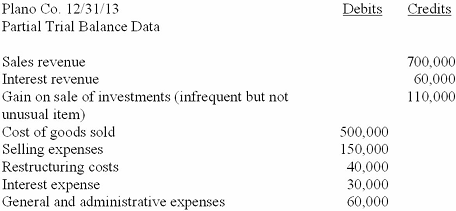

Solved Debits Credits Plano Co 12 31 13 Partial Trial Chegg Com

How Colorado Taxes Work Auto Dealers Dealr Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Taxes And Fees In Lakewood City Of Lakewood

Business Licensing Tax City Of Lakewood

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

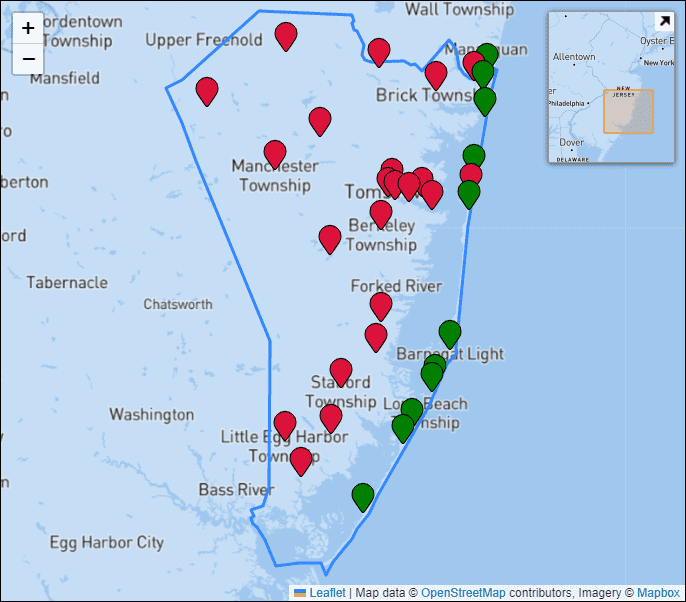

Property Tax Rates And Average Tax Bills In Ocean County New Jersey

How Colorado Taxes Work Auto Dealers Dealr Tax

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation